Sustainability Is Instrumental To Consumers Choosing Diamond Jewelry

Trend being led by younger consumers who value evidence of sustainability credentials.

Sustainability considerations now rank on par with price and design for global consumers when purchasing diamonds, according to new research published today by De Beers Group in the company’s eighth annual Diamond Insight Report, titled Sustainability: shaping the future of the diamond sector.

The report takes an in-depth look at the topic of sustainability in the diamond sector, including how sustainability considerations are influencing consumer decisions relating to natural diamonds, how the diamond industry is already a leader in many areas relating to sustainability, and how the industry must build on its momentum and continue to place sustainability at the heart of its value proposition to meet consumer expectations for the future.

Based on a global study of more than 8,400 people across seven1 key consumer markets for diamonds, the report found that sustainability considerations were influencing consumer purchase decisions across all sectors, with 60 per cent of consumers and more than 80 per cent of opinion leaders (those who influence decisions of friends and family) having chosen to buy a product made in a more environmentally or socially responsible way over any other product.

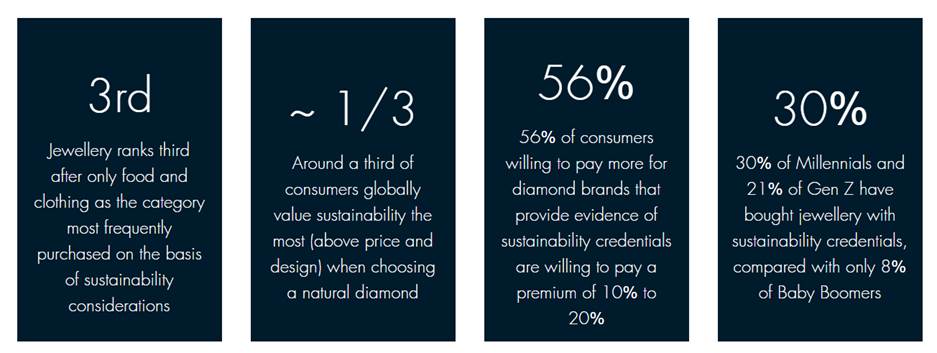

The study also found that fine jewellery ranks third, after only food and clothing, as the category most frequently purchased on the basis of sustainability considerations, with one in five consumers globally having bought jewellery because of its sustainability credentials in recent years. When it came to diamond jewellery, the study found that sustainability considerations were a key factor for consumers in all markets. Sustainability was ranked by 30 per cent of consumers as their most important consideration – above price and design – when choosing a diamond.

The top five sustainability considerations for diamond consumers in the study were protection of the environment, fair worker treatment, conflict-free sourcing, supporting local communities and diamond origin.

These trends are being led by the younger generations, with 30 per cent of Millennials having bought jewellery with sustainability credentials as part of its branding, compared with only eight per cent of Baby Boomers. Sustainability considerations were also higher among consumers with a higher education (67 per cent) and those from affluent backgrounds (70 per cent).

The study also found that sustainability-conscious consumers were prepared to pay a premium for natural diamonds that provide evidence of sustainability credentials, with 56 per cent of consumers who were willing to pay more saying they were willing to pay between 10 and 20 per cent more for natural diamond brands that could demonstrate they operate in an environmentally and socially responsible way. Nearly 17 per cent of these consumers were open to paying 25 per cent or more for a sustainable natural diamond.

The more symbolic and emotive the occasion and the larger the carat weight, the more sensitive consumers were to a brand’s environmental and social values. Sixty-two per cent of people buying natural diamonds for weddings, engagements and anniversaries ranked sustainability factors as the most important in their purchasing decisions. This figure was 50 per cent for self-purchased diamonds and 45 per cent for other occasions such as Christmas, Chinese Lunar New Year, Diwali and Mother’s Day.

When it came to factors that were most influential in shaping consumer perceptions towards sustainability and diamonds, the study found that the opinion of experts (46 per cent), information from the brand itself (40 per cent) and information from retailers (37 per cent) ranked most highly, compared with the opinions of friends and family (21 per cent), and the opinions of influencers (17 per cent) or peers (15 per cent) on social media.

In addition to the research findings, the report also highlights numerous examples demonstrating how the diamond industry is already a sustainability leader in many areas, from supporting local communities and delivering large-scale conservation projects to increasing diversity throughout the value chain and working towards becoming carbon neutral. The report emphasizes that the industry has strong foundations to build from when responding to the consumer trends identified by the research, by more proactively communicating the significant positive impacts that diamonds create on their journey to the consumer.

Bruce Cleaver, CEO, De Beers Group, said: “With sustainability being one of the key mega trends across all consumer sectors, this year’s Diamond Insight Report explores how sustainability factors are influencing consumer attitudes towards diamonds. As is clear from this research, a tipping point has been reached – sustainability is no longer a trend that’s coming over the horizon; it’s already one of the key considerations in diamond purchases.

“As a luxury product that is both unique to each individual and which holds deep emotional meaning, today’s consumers want to know that the diamond they have purchased aligns with their own values and has contributed to a better future for people and the planet – and they increasingly want evidence of this. The natural diamond industry has an impressive – if sometimes poorly understood – recent track record in creating immense and widespread benefits throughout the value chain, with ambitious sustainability commitments for the coming decade and beyond. As this report demonstrates, all players in the industry must now consider how they can best connect consumers more closely to this positive impact, which will be critical to maintaining long-term consumer trust, desire and loyalty.”

The 2021 Diamond Insight Report also includes the annual Diamond Value Chain Dashboard, tracking performance across the diamond industry downstream, midstream and upstream for 2020 and the first half of 2021. De Beers Group’s analysis found that consumer demand for diamonds in the first half of 2021 grew 40 per cent year-on-year or about 15 to 20 per cent on an annualised basis compared with 2019.

The 2021 De Beers Group Diamond Insight Report is available to download here.